| TABLE OF CONTENTS | |

PAGE

| INTRODUCTION | 2 |

| SEVEN CRUCIAL ELEMENTS | 4 |

| PLANNING | 5 |

| PROCUREMENT/SELECTION | 6 |

| PRICE AND COST ANALYSES | 7 |

| AGREEMENTS | 10 |

| Scope of Work | 11 |

| Deliverables | 12 |

| Reports | 14 |

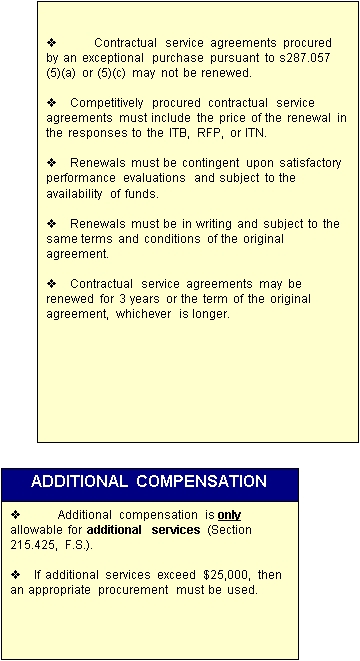

| Modifications, Amendments, Renewals | 15 |

| FILES | 16 |

| MONITORING | 17 |

| Programmatic and Fiscal | 18 | |

| Plan | 20 | |

| Activities | 21 | |

| Corrective Action | 22 | |

| PAYMENTS | 24 |

| CLOSEOUT | 25 |

INTRODUCTION

![]()

Section 17.03, Florida Statutes provides “The Chief Financial Officer of this state, using generally accepted auditing procedures for testing or sampling, shall examine, audit, and settle all accounts, claims, and demands, whatsoever, against the state, arising under any law or resolution of the Legislature, and issue a warrant directing the payment out of the State Treasury such amount as he or she allows thereon.”

The Bureau of Auditing’s mission is to assist the Chief Financial Officer in performing his constitutional and statutory duties by providing assurance to Florida taxpayers that: funds are disbursed from the State Treasury in accordance with applicable laws, rules, and administrative policies; and goods/services have been received as specified in the contract/grant agreement.

PURPOSE OF TRAINING

Comptroller Memorandum No. 8 (2001-2002) was issued that provides for the hold up of funds, offset of funds, etc. due to providers in cases where it is deemed that an agency lacks proper accountability over the use of state funds and/or the delivery of services. The purpose of this training is to improve accountability for state funds by providing guidance to contract and grant managers. Best practice guidelines are presented for crucial areas of the administration process. These guidelines apply regardless of the form of the agreement, e.g. contract, grant, purchase order, memorandum of understanding, etc.

KEY WORDS:

Fiscal Responsibility

Accountability

Documentation

![]()

INTRODUCTION

| REFERENCE MATERIALS FOR CONTRACT/GRANT MANAGEMENT: | |

| Reference Guide for State Expenditures http://www.fldfs.com/aadir/ | |

| Florida Statutes (F.S.) | |

| Florida Administrative Code (F.A.C.) | |

| Catalog of State Financial Assistance (CSFA) | |

| OMB Circulars | |

| Federal Public Laws | |

| Catalog of Federal Domestic Assistance (CFDA) | |

| Code of Federal Regulations (CFR) | |

ETHICS:

The State of Florida has established standards for ethical conduct for

public officials and performing state business. More detailed information

may be found at:

SEVEN CRUCIAL ELEMENTS

![]()

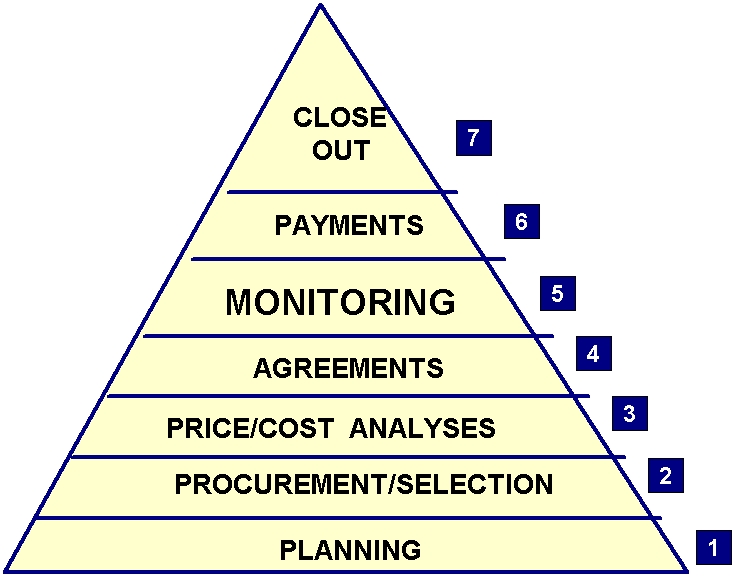

There are seven crucial elements for administering contracts and grants:

PLANNING

![]()

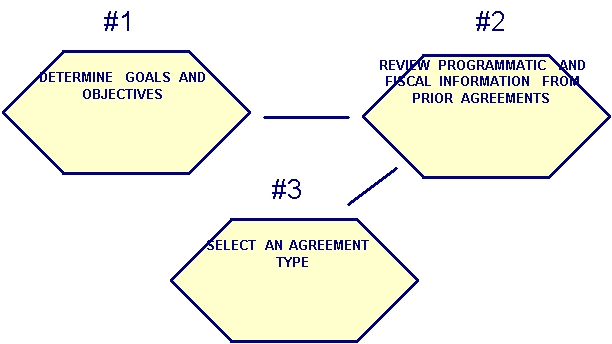

Planning is an essential element in the contract and grant administration process. Goals and objectives are determined by answering the question, “What do we want to accomplish?”

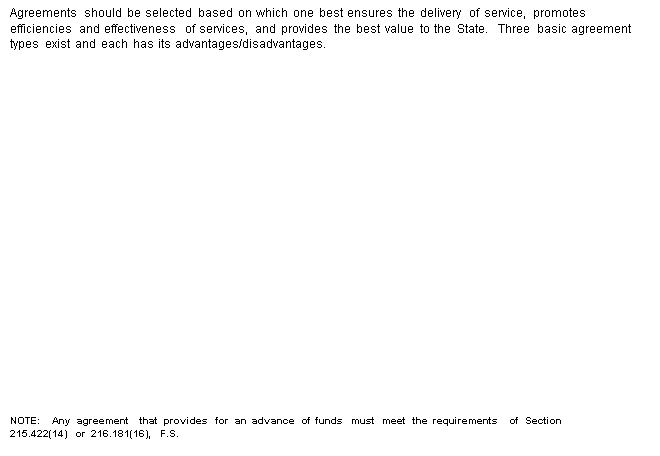

AGREEMENT TYPES |

CONSIDERATIONS |

Fixed Price/Fixed Rate Price |

*Provides greatest incentive for efficient and economical performance *Should only be used if competitively procured and/or historical costs available to provide basis for fixed price. |

Cost Reimbursement |

*Should be used when no competitive procurement and/or no historical cost information is available. *Should include a budget detailing how funds are to be spent and state that all expenditures must be directly related to the project. *Requires more fiscal monitoring. |

Combination |

*Cost plus firm fixed fee (profit)

NOTE: Cost plus percentage of cost should be avoided, as it offers no incentive for the provider to control costs. |

![]()

Agreements with contractors/recipients must be awarded in accordance with applicable laws, rules, and regulations. Each agency should have codified rules for each of their grant programs.

Full and fair open competition is necessary to assure that the State pays a fair and reasonable price for the services to be provided. Based on goals, objectives, needs and historical information, an appropriate procurement method should be selected and fully documented.

Section 287.057, F.S. and Rule 60A-1, F.A.C. provide three competitive procurement methods:

PROCUREMENT METHOD |

CONSIDERATIONS |

Invitation to Bid (ITB) |

*Used when the agency knows exactly what is required.

*Price is the determining factor in the award.

|

Request for Proposal (RFP) |

*Used when the agency has a general idea of what is required.

*Services and price are evaluated.

|

Invitation to Negotiate |

*Used when: -the scope of work has not been accurately or completely defined;

-services can be provided in different ways; or,

-qualifications of provider and quality of work is more important than price.

*Works best when highly technical and/or complex services are being acquired.

* Price is negotiated based on agreed upon scope of work. |

PRICE AND COST ANALYSES

![]()

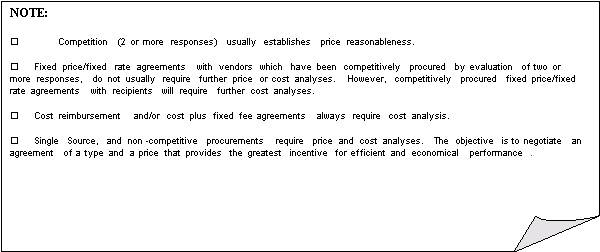

Depending on procurement/selection method and type of agreement to be entered into, price and/or cost analyses should be completed. Section 216.3475 requires that a person or entity that is awarded funding on a non-competitive basis may not be paid more than the competitive market rate.

Definition |

Objective |

Actions |

|

Price Analysis |

The process of examining and evaluating proposed price without evaluating its separate cost elements. |

Verify that overall price is fair and reasonable. |

*Compare current proposed prices

*Compare current price to previous price

|

Cost Analysis |

The process of reviewing and evaluating separate cost elements. |

Determine the allowability, necessity and reasonableness of proposed cost elements. |

*Determine that proposed costs are allowable per federal and state laws, rules and regulations.

*Evaluate necessity for and reasonableness of proposed costs. Give particular attention to fringe benefits, overhead and indirect cost rates, profit margin.

*Compare to actual costs previously incurred for same services. |

EXPENDITURES

![]()

EXPENDITURE GUIDELINES

| Ø | colspan=2 style="border-color:#000080;border-width:2pt;border-style:solid;">Attorney General Opinion states an agency must have expressed or implied statutory authority to expend state funds. | |

| Ø | colspan=2 style="border-color:#000080;border-width:2pt;border-style:solid;">Undocumented expenditures are always unallowable. (Incidental expenditures may be excepted.) | |

| Ø | colspan=2 style="border-color:#000080;border-width:2pt;border-style:solid;">The DFS Reference Guide for State Expenditures is a very helpful tool and has the authority of Florida Administrative Code. | |

| FEDERAL FUNDS – ADDITIONAL REGULATIONS | ||

| 1. | Project CFDA | |

| 2. | Relevant CFRs | |

| 3. | OMB Circulars: | |

| • | A-110 - General Admin. Requirements | |

| • | A-133 - Federal Single Audit | |

| • | A-122 - Cost Principles for Not-for Profits | |

| • | A-87 - Cost Principles for State & Local Govt. | |

| • | A-21 - Cost Principles for Universities | |

PRICE AND COST ANALYSES

Examples of Generally Unallowable Expenditures:

Candy Alcohol Decorations Greeting Cards

Lobbying Personal Cellular Office Parties Entertainment

Telephones

Food* Microwave Ovens** Coffee Pots** Portable heaters**

Refrigerators** Fans** Congratulatory Refreshments

Telegrams

Banquets Catering Gifts/Flowers Promotional Items***

* Unless meals are in accordance with Section 112.061 Florida Statutes.

** If purchased for the personal convenience of staff.

***Generally requires specific statutory authority.

This list is not all-inclusive and is presented for example purposes only. An expenditure of state funds must be authorized by law and the expenditure must meet the intent and spirit of the law authorizing the payment. Some of the items above may be allowable if there is statutory authority for their purchase and other rules or laws do not prohibit them. Agencies should refer to the Reference Guide for State Expenditures and/or their agency legal staff when determining whether specific purchases are allowable pursuant to the laws, rules, and requirements of their agreement and program.

AGREEMENTS

![]()

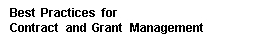

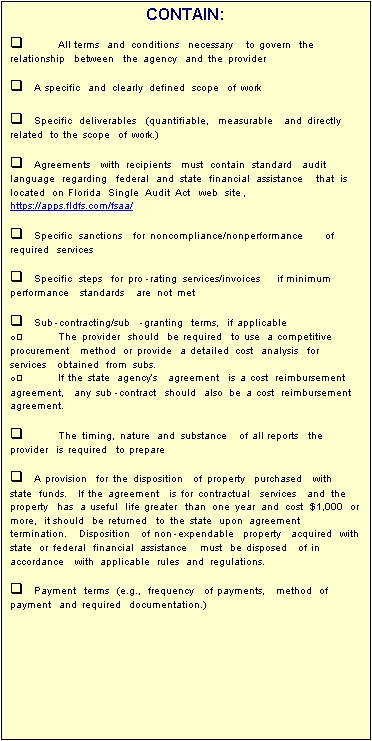

Issuing a clear and complete agreement is a critical component of the contract and grant process. The quality of the agreement can determine whether the agency will maintain control over the project. Additionally, issuing a clear and comprehensive agreement is necessary because the quality of the agreement will have a direct effect on the payment process, the monitoring process, and the overall success of the project.

Agreements should…

![]()

The scope of work should:

| ü | Be specific | |

| ü | Be clearly established | |

| ü | Be directly related to the goals and objectives of the program | |

| ü | Include: | |

| o | All of the activities and services that the provider is to perform | |

| o | All of the products the provider is to furnish | |

| o | Minimum performance standards such as staffing levels, minimum qualifications for staff, number of clients served, etc. | |

EXAMPLES |

Vague |

More Specific |

|

SCOPE OF WORK |

“The provider is to offer an educational program for up to 30 children. Program activities may include tutoring, counseling or other activities. The provider is responsible for providing staff to sufficiently operate the program.” |

“Provider is to conduct an after school study program for 30 at risk children (as defined in Appendix A) on a full time basis (as defined in Appendix B) at the vendor’s location Monday through Friday 2:30PM to 6:30PM for the period of 7/1/04 to 6/30/05 . . .. Staff will consist of 1 supervisor and six tutors who meet the minimum qualifications defined in Appendix C.”

|

| AGREEMENTS: Deliverables | |

Deliverables should:

| ü | Be directly related to the scope of work | |

| ü | Be used to measure the provider’s progress | |

| ü | Be specific, quantifiable, measurable and verifiable | |

| ü | Be every event that will trigger a payment | |

| ü | Be a necessary part of the provider’s performance | |

| ü | Be identified in the agreement along with a description of what constitutes successful performance of the event | |

| ü | Include minimum performance standards. | |

EXAMPLES |

Not Related To the Scope of Work |

Related To the Scope of Work |

|

FIXED PRICE DELIVERABLES |

“Provider will be paid $6,000 each month upon submission of a progress report.”

|

“Provider will be paid $6,000 each month for performing in accordance with the Scope of Work. The provider will submit a progress report by the 15th of the following month attesting to the number of clients served each day and the level of services that were provided. Payment will be reduced by $x for each vacant/unqualified staff position and $x for each enrollment vacancy.”

|

FIXED RATE DELIVERABLES |

“The provider will be paid $300 for each day services are provided up to $6,000 (20 days * $300) per month.”

|

“The provider will be paid $200 per month for each full time participant (as defined in Appendix B) for up to 30 clients for services provided in accordance with the scope of work. The provider will submit a progress report by the 15th of the following month attesting to the number of clients served each day and the level of services that were provided. Payment will be reduced by $x for each vacant/unqualified staff position and $x for each weekday that services are not provided.”

|

| AGREEMENTS: Deliverables | |

EXAMPLES |

Not Related To the Scope of Work |

Related To the Scope of Work |

|

COST REIMBURSEMENT DELIVERABLES

|

“Provider will be reimbursed for expenditures incurred in accordance with the budget.”

|

“Provider will be reimbursed only for budgeted expenses incurred during the agreement time period that are directly related to the project. The provider will submit a progress report by the 15th of the following month attesting to the number of clients served each day and the level of services that were provided. Payment will be reduced $x for each weekday that services are not provided.”

|

| AGREEMENTS: Reports | |

Agreements should clearly describe the timing, nature and substance of all reports the provider is required to prepare.

REPORT CHECKLIST |

ü |

State the date each report is due.

|

|

List the specific information each report is to contain.

v Simply requiring the provider to submit a “report on their progress” is not adequate.

|

|

Require a standard format for reports.

v Information should be presented in a manner that the contract/grant manager would readily identify trends, problems, etc. The format may include narratives, spreadsheets, combinations, etc. Reports may be electronic, paper, or a combination.

|

|

Prescribe the order that records are presented in reports.

v It may be helpful to have records listed alphabetically, chronologically, and/or by a specific identifier such as a social security number.

|

|

Require the provider to maintain documentation to support the information in the reports.

v For example, if the report contains records of clients served, then the provider could maintain a sign in log. The agency must determine whether supporting documentation is submitted with each report.

|

|

Reports are readily reconcilable to the invoices.

|

|

Contain sanctions for failure to submit reports in a timely manner.

|

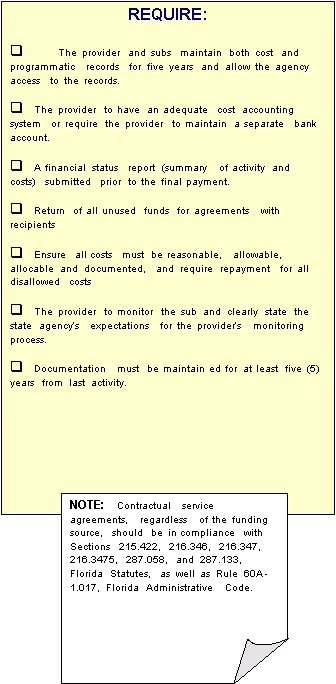

AGREEMENTS: Modifications

![]()

Once an agreement expires or all of the funds have been spent, no alterations can be made. Therefore, all modifications must be made prior to the:

| u | colspan=2 style="border-width:2pt;border-style:solid;">Expiration date of the agreement, | |

| u | colspan=2 style="border-width:2pt;border-style:solid;">Expenditure of all funds, or | |

| u | colspan=2 style="border-width:2pt;border-style:solid;">All contracted services have been delivered. | |

![]()

![]()

![]()

The documentation in the contract/grant file should be neat, complete, and organized. The file should be a tool which anyone can pickup and easily obtain information about the agreement and its current status.

The following table is an example of a contract/grant file contained in a multi-leaf file folder organized into six main sections and the respective, relevant contents.

# |

Section Title |

Contents |

1 |

Contact Record |

Quick reference info (provider name, address, phone, email); contact sheet detailing agreement history (meeting notes, phone contact documentation); calendar showing all reporting dates, payment dates, renewal dates, deliverables schedule.

|

2 |

Authoritative Literature |

Original agreement & amendments; Single Audit Act documentation; Florida statutes, Florida Administrative Code, department rules, appropriation language; subcontracts/subgrants and associated RFPs; provider certifications.

|

3 |

Payment History |

Spreadsheet with running payment balance, warrant copies, voucher copies.

|

4 |

Payment Request |

Invoices, deliverables schedule, deliverables documentation.

|

5 |

Verification |

Site visit documentation, independent documentation supporting deliverables, expense validation, audit reports & findings resolution, reconciliation of audit report expenses versus invoiced expenses, client surveys.

|

6 |

Correspondence |

All correspondence documentation – letters, email copies, vendor–related media copies. |

MONITORING

![]()

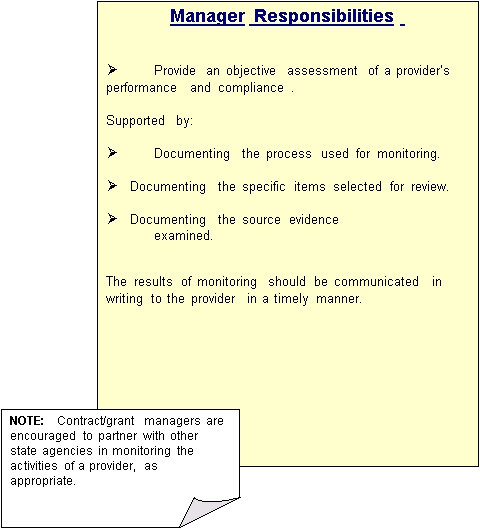

Contract/Grant Monitoring is an involved, interactive, and proactive activity. While the provider has responsibility to perform under the terms of the agreement, the state agency has responsibility for reasonable and objective evaluation of the provider’s performance. Effective monitoring can assist in identifying and reducing fiscal or program risks as early as possible, thus protecting both public funds and ensuring the delivery of required services.

Purpose

Monitoring is a planned, ongoing, and periodic activity to determine:

![]()

| Compliance by the provider with the agreement terms and conditions and any applicable laws and regulations | |

| All required activities are being or have been performed. | |

| Deliverables have been completed | |

| Funds have been accounted for and used appropriately. | |

| FISCAL MONITORING | |

Monitoring involves information collection about provider operations and is not limited to site visits or the completion of formal reviews. Every provider communication is an opportunity to document monitoring activity. Adequate documentation is essential for effective contract/grant monitoring. Contract/grant files should include copies of letters, meeting notes, and documentation of phone conversations as evidence that conscientious monitoring has occurred during the period of the agreement.

Work in this contract/grant management area falls into two general categories: programmatic monitoring and fiscal monitoring.

PROGRAMMATIC MONITORING |

|

FISCAL MONITORING |

q Program monitoring deals more specifically with compliance of program requirements.

q Provider has adequately demonstrated the satisfactory Performance of all services required by the agreement.

q Provider has completed all deliverables.

q Monitor outcomes or goals identified in the agreement

|

q Determine that funds were properly accounted for (separate bank account or project cost records).

q Determine that expenditures were made in accordance with applicable laws, rules and regulations; were authorized by the agreement; were directly related to the project; and were properly supported.

q Verify that total payments are within the limits set by the agreement. |

Prior to conducting monitoring activities, contract/grant manager must fully understand all requirements:

| 1. | colspan=2 style="border-top-width:8pt;border-top-style:solid;border-right-width:1pt;border-right-style:solid;border-bottom-width:1pt;border-bottom-style:solid;">Carefully read the entire agreement. | |

| 2. | colspan=2 style="border-top-width:8pt;border-top-style:solid;border-right-width:1pt;border-right-style:solid;border-bottom-width:1pt;border-bottom-style:solid;">Federal funds – Review cost principles in appropriate OMB Circular. Read corresponding CFDA and any CFRs and Federal Public Laws referenced, etc. | |

| 3. | State grants - Understand the requirements for recipients of State Financial Assistance. Read corresponding CSFA, compliance supplement, etc. | |

| 4. | Understand all rules and laws referenced in the agreement. | |

| 5. | Review the Reference Guide for State Expenditures. | |

| PROGRAMMATIC AND |

| FISCAL MONITORING | |

PROGRAMMATIC MONITORING

| Activity/Requirement | Documentation | |

| Staff Education | ||

| Client Age | ||

| Household Income | ||

| Program Attendance | ||

| Client Contacts | ||

| Job Placement | ||

| Educational Gains | ||

FISCAL MONITORING

| Expenditure | Documentation | |

| Employee salary | ||

| Office Rent | ||

| Consultant | ||

| Office Supplies | ||

| Utilities | ||

| Travel | ||

![]()

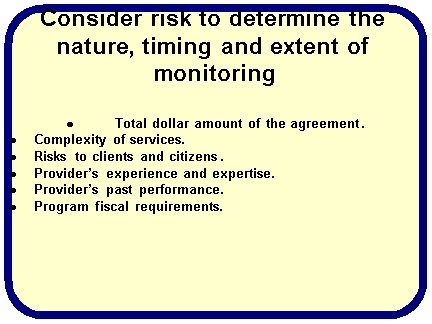

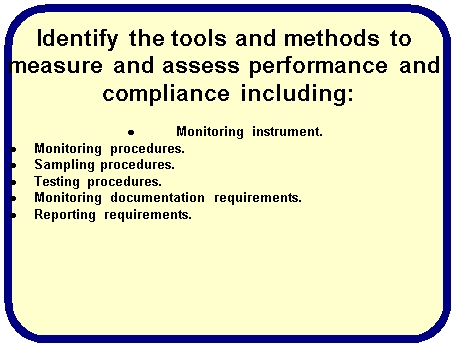

MONITORING PLAN

One means of defining the specific monitoring methods appropriate to a particular program or service and the monitoring activities to be completed for an individual provider is a monitoring plan. Ideally, the monitoring plan will be prepared concurrent with the agreement to ensure consistency and that contract/grant requirements support the planned monitoring activities.

When developing a monitoring plan:

![]()

The type of agreement selected may have an impact on the level and type of monitoring activities required to ensure that the state received the agreed upon services, and where specified, the funds are used as intended. Cost reimbursement agreements, recipient/sub-recipient agreements, agreements that deliver multiple services, or agreements that use multiple funding sources (particularly those supported with federal funds) may require a higher level of monitoring than other agreements. A higher level of monitoring may involve more testing, such as additional review of provider reports and documentation, site visits, or a combination of these methods.

TYPES OF MONITORING ACTIVITY |

ACTIONS |

Periodic Provider Reporting |

Require the provider to submit progress reports or other appropriate data or reports, based on pre-defined criteria, and review the provider’s reports for verification of services provided and adherence to the agreement. Substandard performance should be identified and addressed timely and appropriately.

|

Onsite Reviews and Observations |

Conduct onsite reviews, interview provider staff to ascertain their understanding of program goals, interview clients about services received, review key systems and service documentation, review client case records, review personnel records to ensure staff have appropriate credentials, review fiscal records, and observe operations whenever possible. The results of these visits should be documented in writing and compared with contract/grant requirements.

|

Client Surveys |

Survey clients concerning agreement service delivery and quality. Require the provider to resolve complaints. Keep records of both the complaint and method of resolution.

|

Other Periodic Contact with Provider |

Maintain provider contact to review progress on a regular basis. Good contract/grant monitoring includes a continuous provider dialogue.

|

Agency Review of Audit Reports |

Review any required audit reports and audit work papers and ensure the provider takes appropriate and timely corrective action.

|

Invoice Reviews |

Compare billings with the terms agreed upon in the agreement. Ensure that the costs being charged are within the agreement parameters and required services are being performed. |

Contract/grant problems warranting corrective action typically include:

| u | colspan=2 style="border-width:3pt;border-style:solid;">Failure to ensure client health or safety | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Significant audit or monitoring findings | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Inferior quality of services | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Failure to perform all or part of the agreement | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Late performance | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Late submission of reports on a recurring basis | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Inadequate, unclear, or excessive billing | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Inadequate accounting systems | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Commingling of funds | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Questionable expenditures | |

| u | Unqualified staff | |

| u | Ineligible clients | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Inadequate documentation of service delivery | |

| u | colspan=2 style="border-width:3pt;border-style:solid;">Consultant or sub with unsupported payment rates and/or with an inadequate agreement | |

Corrective action responsibilities of the contract/grant manager typically include:

| u | Communicating remedies, as appropriate, when the provider’s performance is deficient. | |

| u | Seeking specialist advice, including legal counsel, when unsure of the rights of either party or the correct action. | |

CORRECTIVE ACTION

![]()

Addressing Non-Compliance Problems

To address problems, contract/grant managers should:

| u | Document provider conversations and set time frames for corrective action. | ||

| u | Check to see if applicable law or regulations direct how corrective action must occur. If so, comply with the legal requirements. | ||

| u | Clearly identify the problem verbally and in writing. Be specific by using dates, number of occurrences, or other data that quantifies the problem. For example, “Paragraph 4 of your Agreement states that you must submit a report by the 5th of each month. Your reports for May, June, and July were all submitted over five weeks past the due date, and we have not yet received your August report.” | ||

| u | Advise the provider in writing about the requirements to correct the problem or, if appropriate, ask the provider to submit a corrective action plan, including dates when corrective action will be completed. Set a deadline for submission of the plan. If this results in any changes to the agreement, amend the agreement. | ||

| u | Specify a resolution date or time frame. Unless a shorter or longer time frame is warranted, expect corrective action to be completed within one month. | ||

| u | Track all corrective action to ensure completion. | ||

| u | If a deadline is missed or corrective action is otherwise not completed, follow up in writing immediately. Notify the provider that a deadline has been missed and ask the provider when the action will be completed. Advise the provider that failure to comply with the corrective action plan could lead to termination of the agreement. Note: Failure by contract/grant managers to follow up on corrective action could be interpreted later by the court as a waiver. | ||

If the corrective action is successful in resolving problems, notify the provider in writing that resolution has been achieved. Remember to document this in the contract/grant file.

Suspected Criminal Activity

Some activities, such as provider over billing, may be either genuine provider errors or, in extreme cases, may be the result of criminal activity. Generally, the contract/grant manager should consider the provider’s explanations, while remaining sensitive to the possibility of fraud or related criminal activity. Although rare, the contract/grant manager is often the first person with the opportunity to identify suspicious activity and should follow your agency’s process for investigating when criminal activity is suspected.

PAYMENTS

![]()

The provider should submit documentation supporting the delivery of services prior to the payment, regardless of the method of payment. The contract/grant manager’s responsibilities include verifying:

| u | Invoices clearly reflect the description of services, number of units, and the cost per unit. (Rule 69I-40.002, F.A.C.) | |

| u | The payment request/invoice billing period must coincide with documentation submitted | |

| u | Services were rendered within the terms of the agreement and were satisfactory | |

The supporting documentation of agreements must be reviewed to give the contract/grant manager reasonable assurance that services have been completed. It is each agency’s responsibility to determine how often (monthly, quarterly, or annually) to review the documentation for expenditures; however, it is recommended that contract/grant managers not wait until the last payment, especially on multi-million dollar agreements.

Type of Contract |

Payment Verification Actions |

Fixed Unit Rate |

q Verify invoice provides unit description and unit price. q Compare units of service to supporting documentation during monthly billing period. q Verify rate billed coincides with agreement rate. |

Fixed Price |

q Verify invoice amount with the agreement terms. q Review supporting documentation and determine if minimum performance standards are met. q If minimum performance standards are not met, pro-rate invoice. |

Cost Reimbursement |

Verify expenditures are:

q Allowable in the agreement budget q Allowable pursuant to other rules and regulations q Directly related to the scope of work; q Reasonable q Within the agreement period q Documented

Verify minimum performance standards are met and apply sanctions as needed.

NOTE: Unless specified in the contract, fringe benefits will be reimbursed at actual cost. |

Combination Contracts

|

Apply above criteria for appropriate combination. |

![]() CLOSEOUT

CLOSEOUT

Whenever an agreement is closed, programmatic and fiscal information must be gathered and analyzed to determine, “Did we get what we paid for?”

PROGRAMMATIC CLOSEOUT |

|

FISCAL CLOSEOUT |

Closeout includes, but is not limited to, determining and documenting that:

q All deliverables and services have been delivered and accepted in writing. q All reports (including Financial Status Report) have been received and accepted in writing. q Determine whether program objectives were met. q Liquidated damages/sanctions have been assessed for non-performance/non-compliance.

|

Closeout includes, but is not limited to, determining and documenting that: q Acquired non-expendable property has been returned to state. q Advances and/or interest earned on advances have been recovered or applied against what is owed. q Match requirements have been met. q Amounts assessed as liquidated damages/sanctions for non-performance/non-compliance have been recovered. q Disallowed costs and/or unused grant funds have been recovered. q Final payment to provider is made only after all programmatic and fiscal steps have been completed . q *Financial Status Report has been reviewed and approved in writing. q *Cost audit has been performed.

*Required for all agreements except, fixed price/fixed rate agreements with vendors which were competitively procured by evaluation of two or more responses. |

Updated January 2006 - 1 -

Page 5